Table of Contents

Below is a clear, minimal-effort, high-impact Technical Roadmap to help you build your own Chargebee-like Billing & Subscription System that can work globally for SaaS products.

This roadmap focuses on MVP essentials, then Phase-2 enhancements, followed by long-term scalable architecture.

Everything is optimized for minimum development effort, maximum usability, and worldwide readiness.

✅ ⚡ MVP Roadmap

MVP = Minimum Viable Product

It means the smallest, simplest version of a product that you can launch quickly

1. Core Components (MUST-HAVE for MVP)

These are the absolute essentials your system needs to start functioning in production.

1️⃣ Customer Management

Minimum Features:

- Create & update customers

- Store email, name, country, and currency

- Customer dashboard (basic)

- Attach payment methods (via Stripe/PayPal API)

Why this matters: every SaaS needs customer identity + payment method storage.

2️⃣ Product Catalog + Plans

Minimum Features:

- Create Products (e.g., CRM, API Access, etc.)

- Create Plans

- Monthly / Yearly

- Price

- Currency

- Support one-time charges

Optional for MVP but good:

- Addons (extra users, storage, etc.)

3️⃣ Subscription Engine (Core Logic)

This is the brain of your billing system.

Minimum Functionality:

- Start subscription

- Cancel subscription

- Pause / Resume subscription

- Change plan (upgrade/downgrade)

- Auto-renew billing cycle

- Trial periods

Key Logic:

- Billing cycle generator

- Proration engine (optional for MVP)

- Invoice generation engine

4️⃣ Payment Processing Integration

For fastest worldwide readiness → integrate:

Option A (single): Stripe Billing API

Option B (multi): Stripe + PayPal

Minimum Requirements:

- Create checkout session

- Handle webhooks

- payment_success

- payment_failed

- subscription_created

- invoice_payment_failed

- Update your DB based on webhook events

5️⃣ Invoicing System (Essential but Lightweight)

Minimum Features:

- Auto-generate invoices (PDF optional, HTML is enough for MVP)

- Store invoice in DB

- Invoice statuses:

- PAID

- UNPAID

- VOID

- UPCOMING

Optional:

- Manual invoice download as PDF

6️⃣ Webhooks & Events System

Needed so that your frontend app knows:

- subscription activated

- payment succeeded

- payment failed

- subscription cancelled

- invoice created

You need:

- Event emitter

- Webhook delivery retry system (at least 3 retries)

7️⃣ Basic Dashboard (Admin UI)

For your internal team:

- Customer list

- Subscription list

- Plan management

- Payment logs

- Event logs

Make it simple, not fancy.

8️⃣ Global SaaS Readiness (Minimum)

- Multi-currency pricing (USD, EUR, GBP, INR at minimum)

- Tax support (basic): add custom GST/VAT %

- Timezone support

- Country-based pricing (optional)

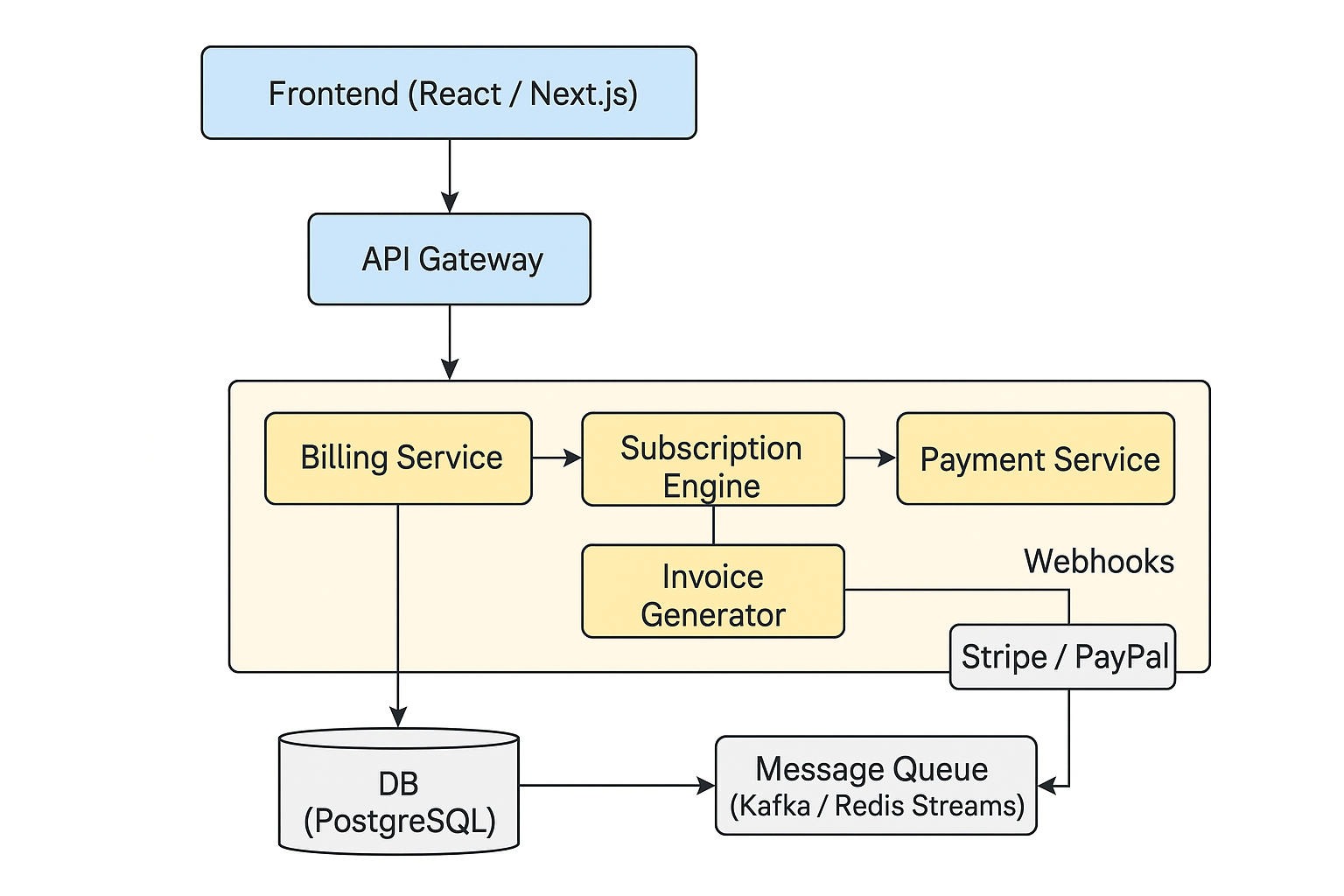

⭐ MVP Architecture

Frontend (React / Next.js)

|

API Gateway

|

Billing Service ---- Subscription Engine

| |

| ----- Invoice Generator

|

Payment Service ---- Stripe/PayPal Integrations

|

Event Service ---- Webhooks

|

DB (PostgreSQL)

|

Message Queue (Kafka/Redis Streams or SQS)

🚀 PHASE-2 FEATURES (After MVP is Live)

1. Advanced Subscription Features

- Usage-based billing

- Metered billing

- Overages

- Seat-based billing

- Multi-tenancy support

- Multiple payment methods

2. Revenue Recovery

- Smart dunning (retry logic)

- Email notifications:

- Payment failed

- Card expiring

- Invoice reminders

3. Tax & Compliance

- Automated GST/VAT via TaxJar

- EU VAT validation

- Multi-country tax rules

4. Analytics Dashboards

- MRR / ARR

- Churn rate

- Active subscribers

- Revenue per plan

5. Integrations

- Webhooks (customer apps)

- Zapier

- Slack

- Salesforce

- HubSpot

🔥 PHASE-3 (Long Term / Enterprise Level)

1. Multi-Gateway Architecture

- Stripe

- Razorpay

- PayPal

- Adyen

- Apple/Google In-app billing

2. PCI-DSS Certification (For card storage)

Only required if you store card details yourself.

Recommended approach: don’t store cards — use Stripe tokens.

3. Ledger System

For finance compliance:

- Immutable ledger

- Double-entry accounting

- Audit reports

4. Marketplace / Multiple Vendors

Like Chargebee Enterprise.

🧱 Minimum Tech Stack Recommendation

| Component | Recommended |

|---|---|

| Backend | Java Spring Boot / Node.js (Fastify/NestJS) |

| Frontend | React / Next.js |

| DB | PostgreSQL (schemas for multi-tenancy) |

| Cache | Redis |

| Queue | Kafka / Redis Streams |

| Payments | Stripe + PayPal |

| Deployment | Kubernetes / ECS |

| Logging | ELK Stack or DataDog |

🎯 MVP Feature Summary for Quick Execution

Minimum Required

- Customer System

- Product & Plans

- Basic Subscription Engine

- Stripe Payments + Webhooks

- Invoice Generator

- Dunning (simple retry)

- Admin Dashboard

- Multi-currency & basic tax

- API for integration

Within 6–8 Weeks Timeline (Small Team)

Yes, this is feasible if scoped properly.

Complete Database Schema

-- Billing System Database Schema (PostgreSQL)

-- Purpose: Minimal-complete schema for a Chargebee-like SaaS billing platform.

-- Notes:

-- * Uses UUID primary keys (pgcrypto/gen_random_uuid())

-- * Uses JSONB for extensible metadata where helpful

-- * Designed for multi-currency, multi-tenant SaaS

-- * Keep proration/usage and ledger primitives for future features

-- Enable UUID function

CREATE EXTENSION IF NOT EXISTS pgcrypto;

-- Tenants (optional, for multi-tenant deployments)

CREATE TABLE tenants (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

name TEXT NOT NULL,

slug TEXT NOT NULL UNIQUE,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Customers (the buyer)

CREATE TABLE customers (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

external_id TEXT, -- optional mapping to external CRM/legacy ID

email CITEXT NOT NULL,

first_name TEXT,

last_name TEXT,

phone TEXT,

default_currency CHAR(3) DEFAULT 'USD',

default_payment_method_id UUID, -- FK set later to payment_methods

billing_address JSONB,

shipping_address JSONB,

tax_exempt BOOLEAN DEFAULT FALSE,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now(),

UNIQUE (tenant_id, email)

);

-- Payment methods (tokenized; do NOT store raw PAN)

CREATE TABLE payment_methods (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

customer_id UUID REFERENCES customers(id) ON DELETE CASCADE,

provider VARCHAR(50) NOT NULL, -- e.g., stripe, paypal

provider_payment_method_id TEXT NOT NULL, -- token/id from provider

type VARCHAR(50), -- card, ach, upi etc

card_brand TEXT,

card_last4 TEXT,

card_exp_month INT,

card_exp_year INT,

billing_details JSONB,

is_default BOOLEAN DEFAULT FALSE,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Products (e.g., "CRM Suite")

CREATE TABLE products (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

name TEXT NOT NULL,

description TEXT,

metadata JSONB DEFAULT '{}'::jsonb,

active BOOLEAN DEFAULT TRUE,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Plans (pricing tiers under products)

CREATE TABLE plans (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

product_id UUID REFERENCES products(id) ON DELETE CASCADE,

plan_key TEXT NOT NULL, -- internal key (e.g., "starter_monthly")

name TEXT NOT NULL,

billing_period INTERVAL NOT NULL DEFAULT '1 month', -- 1 month, 1 year

interval_count INT DEFAULT 1,

trial_period_days INT DEFAULT 0,

billing_cycle_anchor TEXT DEFAULT 'start_of_period',

currency CHAR(3) NOT NULL DEFAULT 'USD',

amount_cents BIGINT NOT NULL, -- amount in smallest currency unit

setup_fee_cents BIGINT DEFAULT 0,

billing_behavior TEXT DEFAULT 'charge_automatically', -- other: send_invoice

active BOOLEAN DEFAULT TRUE,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now(),

UNIQUE (tenant_id, plan_key)

);

-- Addons (optional extra charges attached to subscriptions)

CREATE TABLE addons (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

name TEXT NOT NULL,

description TEXT,

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

billing_period INTERVAL,

metadata JSONB DEFAULT '{}'::jsonb,

active BOOLEAN DEFAULT TRUE,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Coupons / Discounts

CREATE TABLE coupons (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

code TEXT NOT NULL,

description TEXT,

discount_percent NUMERIC CHECK (discount_percent >= 0 AND discount_percent <= 100),

discount_cents BIGINT, -- fixed amount off (in smallest currency unit)

currency CHAR(3),

duration TEXT DEFAULT 'once', -- once, forever, repeating

duration_in_months INT,

max_redemptions INT,

expires_at TIMESTAMPTZ,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now(),

UNIQUE (tenant_id, code)

);

CREATE TABLE coupon_redemptions (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

coupon_id UUID REFERENCES coupons(id) ON DELETE CASCADE,

customer_id UUID REFERENCES customers(id) ON DELETE CASCADE,

subscription_id UUID REFERENCES subscriptions(id) ON DELETE SET NULL,

redeemed_at TIMESTAMPTZ DEFAULT now(),

metadata JSONB DEFAULT '{}'::jsonb

);

-- Subscriptions

CREATE TABLE subscriptions (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

customer_id UUID REFERENCES customers(id) ON DELETE CASCADE,

plan_id UUID REFERENCES plans(id) ON DELETE SET NULL,

status TEXT NOT NULL DEFAULT 'active', -- active, past_due, canceled, trialing, unpaid

quantity INT DEFAULT 1,

current_period_start TIMESTAMPTZ,

current_period_end TIMESTAMPTZ,

trial_start TIMESTAMPTZ,

trial_end TIMESTAMPTZ,

cancel_at_period_end BOOLEAN DEFAULT FALSE,

canceled_at TIMESTAMPTZ,

start_date TIMESTAMPTZ DEFAULT now(),

ended_at TIMESTAMPTZ,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Subscription items (for multiple prices or addons attached to a subscription)

CREATE TABLE subscription_items (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

subscription_id UUID REFERENCES subscriptions(id) ON DELETE CASCADE,

plan_id UUID REFERENCES plans(id) ON DELETE SET NULL,

addon_id UUID REFERENCES addons(id) ON DELETE SET NULL,

quantity INT DEFAULT 1,

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

billing_period INTERVAL,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Usage records (for metered billing)

CREATE TABLE usage_records (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

subscription_item_id UUID REFERENCES subscription_items(id) ON DELETE CASCADE,

usage_date DATE NOT NULL,

quantity NUMERIC NOT NULL,

description TEXT,

processed BOOLEAN DEFAULT FALSE,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now()

);

-- Invoices

CREATE TABLE invoices (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

customer_id UUID REFERENCES customers(id) ON DELETE CASCADE,

subscription_id UUID REFERENCES subscriptions(id) ON DELETE SET NULL,

invoice_number TEXT NOT NULL,

status TEXT NOT NULL DEFAULT 'draft', -- draft, open, paid, void, uncollectible

currency CHAR(3) NOT NULL DEFAULT 'USD',

subtotal_cents BIGINT DEFAULT 0,

tax_cents BIGINT DEFAULT 0,

total_cents BIGINT DEFAULT 0,

amount_due_cents BIGINT DEFAULT 0,

amount_paid_cents BIGINT DEFAULT 0,

due_date TIMESTAMPTZ,

closed_at TIMESTAMPTZ,

pdf_url TEXT,

lines JSONB DEFAULT '[]'::jsonb, -- optional denormalized line items

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now(),

UNIQUE (tenant_id, invoice_number)

);

-- Invoice line items (normalized)

CREATE TABLE invoice_items (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

invoice_id UUID REFERENCES invoices(id) ON DELETE CASCADE,

subscription_id UUID REFERENCES subscriptions(id) ON DELETE SET NULL,

subscription_item_id UUID REFERENCES subscription_items(id) ON DELETE SET NULL,

description TEXT,

quantity NUMERIC DEFAULT 1,

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

period_start TIMESTAMPTZ,

period_end TIMESTAMPTZ,

tax_cents BIGINT DEFAULT 0,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Payments (records of payments attempted/received)

CREATE TABLE payments (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

customer_id UUID REFERENCES customers(id) ON DELETE SET NULL,

invoice_id UUID REFERENCES invoices(id) ON DELETE SET NULL,

payment_method_id UUID REFERENCES payment_methods(id) ON DELETE SET NULL,

provider VARCHAR(50) NOT NULL, -- stripe, paypal

provider_payment_id TEXT,

status TEXT NOT NULL DEFAULT 'processing', -- processing, succeeded, failed, refunded

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

captured BOOLEAN DEFAULT TRUE,

failure_code TEXT,

failure_message TEXT,

refunded_amount_cents BIGINT DEFAULT 0,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Refunds

CREATE TABLE refunds (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

payment_id UUID REFERENCES payments(id) ON DELETE SET NULL,

provider_refund_id TEXT,

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

reason TEXT,

status TEXT DEFAULT 'pending', -- pending, succeeded, failed

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Tax rates (basic support)

CREATE TABLE tax_rates (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

name TEXT,

country CHAR(2),

region TEXT,

rate_percent NUMERIC NOT NULL,

inclusive BOOLEAN DEFAULT FALSE,

active BOOLEAN DEFAULT TRUE,

created_at TIMESTAMPTZ DEFAULT now(),

updated_at TIMESTAMPTZ DEFAULT now()

);

-- Dunning / Retry attempts

CREATE TABLE payment_attempts (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

invoice_id UUID REFERENCES invoices(id) ON DELETE SET NULL,

payment_method_id UUID REFERENCES payment_methods(id) ON DELETE SET NULL,

attempt_number INT DEFAULT 1,

status TEXT DEFAULT 'failed', -- succeeded, failed

failure_code TEXT,

failure_message TEXT,

next_retry_at TIMESTAMPTZ,

processed_at TIMESTAMPTZ,

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now()

);

-- Events / Webhooks received from payment providers

CREATE TABLE provider_events (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

provider VARCHAR(50) NOT NULL,

provider_event_id TEXT NOT NULL,

payload JSONB,

processed BOOLEAN DEFAULT FALSE,

received_at TIMESTAMPTZ DEFAULT now(),

processed_at TIMESTAMPTZ

);

-- Outgoing webhooks to customer systems

CREATE TABLE outgoing_webhooks (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

target_url TEXT NOT NULL,

event_type TEXT NOT NULL,

payload JSONB NOT NULL,

attempts INT DEFAULT 0,

last_attempt_at TIMESTAMPTZ,

success BOOLEAN DEFAULT FALSE,

created_at TIMESTAMPTZ DEFAULT now()

);

-- Ledger (basic immutable ledger for accounting)

CREATE TABLE ledger_entries (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

entry_date DATE NOT NULL DEFAULT CURRENT_DATE,

reference_type TEXT, -- invoice, payment, refund

reference_id UUID,

account TEXT NOT NULL, -- e.g., revenue, receivables

amount_cents BIGINT NOT NULL,

currency CHAR(3) NOT NULL DEFAULT 'USD',

debit_or_credit TEXT NOT NULL CHECK (debit_or_credit IN ('debit','credit')),

metadata JSONB DEFAULT '{}'::jsonb,

created_at TIMESTAMPTZ DEFAULT now()

);

-- Audit logs (who did what)

CREATE TABLE audit_logs (

id UUID PRIMARY KEY DEFAULT gen_random_uuid(),

tenant_id UUID REFERENCES tenants(id) ON DELETE CASCADE,

actor_id UUID, -- user/admin id

actor_type TEXT, -- admin, system

action TEXT NOT NULL,

subject_type TEXT,

subject_id UUID,

data JSONB,

created_at TIMESTAMPTZ DEFAULT now()

);

-- Indexes for performance (examples)

CREATE INDEX idx_customers_tenant_email ON customers(tenant_id, email);

CREATE INDEX idx_subscriptions_customer ON subscriptions(customer_id);

CREATE INDEX idx_invoices_customer_status ON invoices(customer_id, status);

CREATE INDEX idx_payments_invoice_status ON payments(invoice_id, status);

CREATE INDEX idx_usage_records_processed ON usage_records(processed);

-- Triggers to keep updated_at current (simple examples)

CREATE OR REPLACE FUNCTION touch_updated_at()

RETURNS TRIGGER AS $$

BEGIN

NEW.updated_at = now();

RETURN NEW;

END;

$$ LANGUAGE plpgsql;

-- Add triggers to a few tables

CREATE TRIGGER touch_customers_updated

BEFORE UPDATE ON customers

FOR EACH ROW EXECUTE PROCEDURE touch_updated_at();

CREATE TRIGGER touch_subscriptions_updated

BEFORE UPDATE ON subscriptions

FOR EACH ROW EXECUTE PROCEDURE touch_updated_at();

CREATE TRIGGER touch_invoices_updated

BEFORE UPDATE ON invoices

FOR EACH ROW EXECUTE PROCEDURE touch_updated_at();

-- Sample sequences / helpers

-- A simple helper to generate readable invoice numbers (tenant-scoped)

CREATE TABLE invoice_counters (

tenant_id UUID PRIMARY KEY REFERENCES tenants(id) ON DELETE CASCADE,

last_serial BIGINT DEFAULT 0

);

CREATE OR REPLACE FUNCTION next_invoice_number(p_tenant_id UUID)

RETURNS TEXT LANGUAGE plpgsql AS $$

DECLARE

s BIGINT;

BEGIN

LOOP

UPDATE invoice_counters SET last_serial = last_serial + 1 WHERE tenant_id = p_tenant_id RETURNING last_serial INTO s;

IF FOUND THEN

RETURN to_char(s, 'FM000000');

END IF;

BEGIN

INSERT INTO invoice_counters (tenant_id, last_serial) VALUES (p_tenant_id, 0);

EXCEPTION WHEN unique_violation THEN

-- concurrent insert, loop and try again

END;

END LOOP;

END;

$$;

-- Example: create a function to reconcile invoice totals (simplified)

CREATE OR REPLACE FUNCTION recompute_invoice_totals(p_invoice_id UUID)

RETURNS VOID LANGUAGE plpgsql AS $$

DECLARE

s_subtotal BIGINT := 0;

s_tax BIGINT := 0;

s_total BIGINT := 0;

s_paid BIGINT := 0;

BEGIN

SELECT COALESCE(SUM(amount_cents),0) INTO s_subtotal FROM invoice_items WHERE invoice_id = p_invoice_id;

SELECT COALESCE(SUM(tax_cents),0) INTO s_tax FROM invoice_items WHERE invoice_id = p_invoice_id;

s_total := s_subtotal + s_tax;

SELECT COALESCE(SUM(amount_cents),0) INTO s_paid FROM payments WHERE invoice_id = p_invoice_id AND status = 'succeeded';

UPDATE invoices SET subtotal_cents = s_subtotal, tax_cents = s_tax, total_cents = s_total, amount_paid_cents = s_paid, amount_due_cents = GREATEST(s_total - s_paid, 0), updated_at = now() WHERE id = p_invoice_id;

END;

$$;

-- End of schema

-- You can extend this schema with: tenant-specific settings, feature flags, advanced tax tables, currency conversion rates, localization tables, and compliance fields (GDPR, consent timestamps).

\Complete System Design Diagram

Security & Compliance

- PCI: do not store card PAN/CVV. Use Stripe Elements or tokenization. If you must store cards (not recommended) — follow PCI-DSS and apply for SAQ/DSS.

- TLS everywhere (mTLS for internal services optional).

- Role-based access control (RBAC) for admin console.

- Secrets: use HashiCorp Vault / cloud KMS.

- Data encryption at rest for DB and object storage.

- Audit logs for all financial operations (immutable where possible).

- GDPR: customer deletion flows — anonymize data with retention windows, keep ledger entries as required by law (mark PII redacted).

Observability & SLOs

Instrumentation:

- Distributed tracing: OpenTelemetry -> Jaeger/Tempo.

- Metrics: Prometheus, Grafana dashboards (MRR, failed payments rate, invoice generation time, queue lag).

- Logs: structured logs to ELK / Datadog / Splunk.

- Alerting: high failure-rate for payments, pod crash loops, DB replication lag, queue consumer lag.

SLO examples:

- Payment success flow end-to-end: 99.9% within 10s (excluding external provider delays).

- Webhook processing: 99.5% within 30s.

- Invoice generation latency: 99% under 2 minutes.

CI/CD & Release strategy

- Git per service (mono-repo optional with clear build pipelines).

- Build → unit tests → integration tests (with test containers for DB) → deploy to staging.

- Canary/Grey deployments with feature flags (LaunchDarkly).

- Blue/Green or Rolling for critical services (Payment Service).

- Migration strategy: use versioned DB migrations (Flyway / Liquibase).

Multi-region & Global considerations

- Localize currency and date/time formatting at UI and invoices.

- For GDPR/EU and local tax: host tenant data in region if requested (data residency) — design by making tenant->region mapping.

- Consider read-replicas in target regions; write region ideally single region per tenant.

- Use CDN for static assets and invoice PDFs.

Developer UX — SDKs & API design

- Provide REST + OpenAPI spec and client SDKs (Node, Java, Python) to increase adoption.

- Design APIs to be intuitive:

POST /v1/subscriptionswithidempotency-keyGET /v1/customers/{id}POST /v1/invoices/{id}/pay

- Provide webhooks docs and test sandbox.

Operational Runbook (short)

- Payment webhook fails: look up provider_event, reconcile payment state, replay events from provider UI.

- Message backlog grows: check consumer lag, scale consumers, inspect slow consumer logs.

- Invoice numbers gap: investigate invoice_counters; use atomic serial function (already in schema).

- Refunds stuck: check provider refund status, reconcile with ledger entries.

Suggested Tech Stack (practical)

- Backend: Java (Spring Boot) or Node.js (NestJS) or Go — choose based on team skill.

- API Gateway: Kong / Nginx / AWS ALB + OIDC provider.

- Messaging: Kafka (high throughput) or Redis Streams (simpler).

- DB: PostgreSQL (per service), Timescale for metrics if needed.

- Cache: Redis.

- Storage: Amazon S3 / MinIO.

- Infra: Kubernetes (EKS/GKE/AKS) or ECS/Fargate.

- Observability: Prometheus + Grafana + Jaeger + ELK.

- CI/CD: GitHub Actions / GitLab CI / Jenkins.

- Payment Providers: Stripe (primary), PayPal / Razorpay / Adyen (regional).

Phased implementation plan (suggested)

Phase 4: Enterprise features (multi-tenant isolation, marketplace).

Phase 0: Infra, CI/CD, API Gateway, Auth Service.

Phase 1 (MVP): Catalog, Customer, Subscription, Payment connector (Stripe), Invoice, minimal Admin UI, Event Bus, Outbox.

Phase 2: Dunning, Usage Metering, Webhook Dispatcher, Ledger, Refunds.

Phase 3: Multi-gateway, tax automation, analytics, multi-region, PCI roadmap if needed.

Below are the major real-world challenges you will face while building and operating a Billing & Subscription Management System (Chargebee-like).

This list includes engineering, business, finance, and compliance challenges — based on how leading billing platforms operate.

🚨 Top Challenges in Building a Billing System

1. Complexity of Subscription Lifecycle

Subscriptions are not just “create and renew.” You must handle:

- Plan changes (upgrade, downgrade)

- Proration (mid-cycle billing)

- Trials, extensions, free credits

- Scheduled changes (future plan switches)

- Pause / resume

- Auto-cancel rules

- Multi-quantity subscriptions

- Metered/usage-based billing

These flows multiply quickly and become challenging to keep consistent and bug-free.

2. Multi-Currency & Global Billing Rules

Billing systems must support worldwide SaaS:

- Different currencies

- Localized invoice formats

- Currency conversion at correct FX rate

- Rounding rules (varies by country)

- Region-specific tax laws (GST, VAT, EU VAT, GST-AU)

Each of these requires domain expertise and continuous updates.

3. Tax Compliance (VAT, GST, Sales Tax)

Tax rules change frequently. Challenges:

- Different tax rates by country/state

- Reverse charge rules

- EU OSS rules

- B2B vs B2C tax differences

- Digital service tax in 40+ countries

- Exemptions and VAT/GST ID validation

- Accurate invoice representation

This is extremely hard to maintain without integrating providers like TaxJar / Avalara.

4. Payment Gateway Variations & Failures

Every payment gateway behaves differently:

- Different APIs (Stripe, Razorpay, PayPal, Adyen)

- Different webhook formats

- Different payment states

- Random downtime

- Card declines for many reasons

- Currency support differences

Ensuring idempotent, fault-tolerant payment processing is a major challenge.

5. Dunning & Payment Recovery Logic

Recovering failed payments is critical for SaaS revenue. Challenges:

- Smart retry strategy

- Handling soft/hard declines

- Timezone-aware retry windows

- Notifications and escalations

- Grace periods

- Suspensions vs cancellations

- Plan downgrade after failure

Bad dunning directly = revenue loss.

6. Handling Usage & Metered Billing at Scale

Usage billing seems simple, but challenges include:

- Billions of usage records

- Duplicate submissions

- Idempotency

- Real-time aggregation

- Backfill & correction

- Delayed reporting

- Large tenants with high throughput

Netflix, AWS, Twilio use extremely complex metering pipelines.

7. Invoice Generation & Numbering

Invoices must be:

- Legally compliant

- Sequentially numbered

- Immutable after finalization

- Localized (PDF, language, currency)

- Accurate tax amounts

- Correct line-item breakdown

A single mistake breaks compliance in many countries.

8. Ledger & Financial Accuracy

A billing system must maintain audit-grade accounting integrity:

- Rigid double-entry ledger

- No negative invoices

- Refund adjustments

- Invoice-credit-note accounting

- FX gain/loss accounting

- Immutable audit logs

This is the hardest part of enterprise-grade billing systems.

9. Multi-Tenancy Challenges

If your system supports multiple SaaS companies:

- Tenant isolation in DB

- Rate limits per tenant

- Custom features per tenant

- Custom taxes/currencies

- Security boundaries

- Global outages affecting all tenants

Most failures come from poor multi-tenancy design.

10. Event Consistency & State Conflicts

Your billing platform depends on async events:

subscription.createdinvoice.generatedpayment.succeededpayment.failed

Challenges:

- Duplicate events

- Out-of-order events

- Lost webhooks

- Race conditions

- Event replay issues

Requires patterns like transactional outbox, idempotency, message versioning.

11. Compliance & Security Requirements

Billing touches financial data; must meet standards:

- PCI-DSS (if storing cards)

- SOC2

- GDPR (data privacy & deletion)

- Data residency (EU, AU, US)

- Secure token storage

- Audit trails

- PII encryption

You must prove that your system is compliant to enterprise buyers.

12. Pricing Experiments & Flexibility

SaaS companies frequently change pricing:

Challenges include:

- Plan versioning

- Grandfathering old customers

- Custom contracts for enterprise clients

- Usage-based pricing variations

- Introductory discounts

- Coupons, promo codes

- Volume-based discounts

Your system must allow these without breaking old subscriptions.

13. Recovering from Webhook Failures

Payment gateways send critical webhooks:

- Payment success

- Payment failure

- Refund processed

- Chargeback initiated

Challenges:

- Retries

- Idempotency

- Out-of-order processing

- Webhook signature verification

- Webhook replay logic

A single missed webhook → incorrect invoice → angry customer.

14. Scaling Events & Batch Jobs

Billing cycles (monthly/weekly/daily) create load spikes:

- Millions of invoices generated at midnight UTC

- Batch payment runs

- Dunning queues

- Usage aggregation windows

Requires distributed schedulers and horizontal scaling.

15. Customer Expectations

Today’s customers demand:

- Instant provisioning

- Real-time dashboards

- Reliable invoices

- Smooth failed payment recovery

- Clear transactional emails

- Integrations with Zapier, Slack, Quickbooks, CRM systems

Meeting all expectations is hard.

16. Global Availability & Latency

If your SaaS is worldwide:

- Users in US, EU, India, Australia need low-latency API access

- Payment providers region-specific

- Data residency rules

- Multi-region failovers

Setting up multi-region architecture is expensive & complex.

17. Maintaining Backward Compatibility

Billing events and APIs cannot be changed easily — customers rely on them.

Challenges:

- Versioning REST APIs

- Versioning events

- Backward compatibility for integrations

- Deprecation timelines

Billing is a core part of revenue — break nothing.

18. Integrations

Billing system must integrate with many external systems:

- CRM (HubSpot, Salesforce)

- Accounting (Quickbooks, Xero)

- Payment gateways

- Tax systems

- Analytics platforms

- Custom internal ERPs

Every integration brings complexity, rate limits, and event-mapping issues.

19. Real-Time Reporting

Customers want dashboards showing:

- MRR / ARR

- Churn

- Expansion revenue

- Cohorts

- Usage consumption

Challenge:

- Large computations

- Real-time updates

- Multi-tenant isolation

- Aggregation from multiple microservices

20. Cost Control & Performance

Billing systems process heavy workloads.

Challenges include:

- Kafka cluster cost

- High DB IOPS

- PDF generation cost

- Caching infrastructure

- Multi-region traffic costs

- Large invoice history storage

Optimize without compromising reliability.

🔥 Final Summary — The Hardest Parts

The top 3 hardest challenges in building a billing system are:

- 1️⃣ Maintaining accurate financial & tax compliance

- 2️⃣ Ensuring payment reliability & dunning

- 3️⃣ Handling complex subscription lifecycle + proration + usage

If you solve these properly, your billing system becomes world-class.